How can integrated reports serve your financial decision making?

Data plays a crucial part in businesses’ performance and future. Without proper analysis of data in hand, you’re just moving with no purpose and financial reporting is a remarkable aspect of business operations and without it, there’s no need for management in the first place.

The objective of financial data is to enable restaurateurs and business owners to make investments and credit decisions in addition to many other decisions that affect all aspects of operations from sales, marketing, employee management to customer relations and cost management.

How do you think the biggest restaurants with multiple chains have originally taken the decision of expansion? Was it a lucky choice?

As tempting as it may sound, luck has nothing to with it. Tracking, monitoring, analyzing data and taking decisions accordingly is the reason why businesses succeed because these different financial activities inspect all your operations in various departments enabling you to evaluate performance and track the flaws of your decisions.

That’s why, integrated reporting at restaurants is the answer for your problematic questions.

What reports should your restaurant POS provide you with?

Sales report

Sales are dissected into numerous sections and should be analyzed from different aspects to be studied.

Sales by outlet: it is impossible for a business owner to be present at different outlets at the same time and he shouldn’t be. Reports help restaurateurs manage different outlet operations and track their performance without the need to perform daily visits to each location.

Sales by employee or department: tracking sales performed by each department, or each employee helps you evaluate your staff and set their rewards or compensations.

Top and worst selling items: you should be aware of your top selling item as well your worst selling one to be able to boost their sales or your profitability. You may decide to change the item’s ingredients or offer a discount on it.

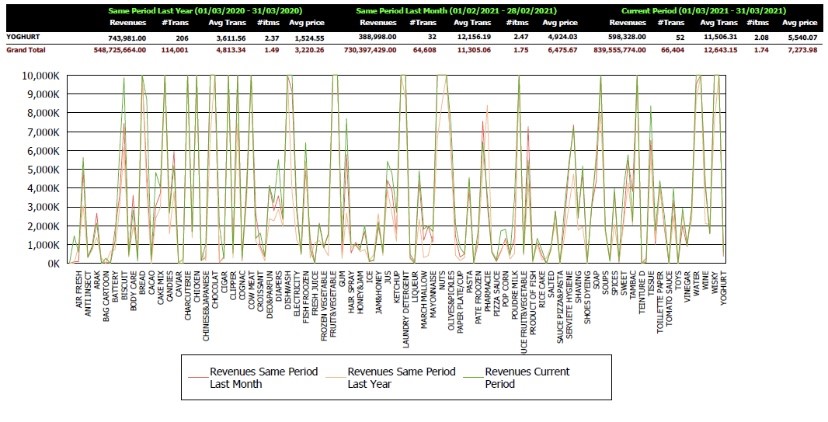

Growth report: These reports show you how you developed your sales between two different periods od time.

Knowing this information sets your marketing strategy to market certain items or to target certain audience and even affects your menu engineering.

Labor reports

Attendance reports: monitor employees’ schedule and logins to determine their commitment and seriousness.

Performance reports: you need to calculate table turnover numbers, orders by employees, number of tables each employee has served to evaluate their performance and reward them accordingly.

Audit kitchen reports

Kitchen order ticket tracking: you need to identify details about every order made on a particular day to prioritize orders and kitchen operations in addition to tracking orders by bill number to organize your deliveries and preparations.

Your front-of the-house staff might come first when it comes to monitoring your staff, but you can’t neglect the operations and the efficiency of tasks performed at the back-of-the-house. Audit reports enable you to track tickets by the hour and in details till the time of serving the orders so you can monitor the performance of your kitchen staff.

Gift card and reward reports

Track your gift cards and rewards campaigns with this report to gain insights into transactions using these cards with detailed transaction information with the points used and remained and dates. You need this report to evaluate the effectiveness of your reward campaigns for you to try another campaign in case of failure.

Payment reports

Payment reports that include cash inflow and outflow and method of payments are crucial to identify your cash flow, cash events, refund reports, voided sales and reports on coupons.

Payout reports

You may have a payout tipping policy where your staff takes out cash at the end of every shift. The payout report shows you the amount of each pay out issued so you can align it with your labor reports to make sure everything is going correctly

Tax reports

Tax reports show you if you’re up to date with your tax duties by showing you an estimate of daily cash and credit card sales and it’s crucial to have it especially when managing multiple outlets. In addition, it shows you all the settled bills that contain discounts, tips and split payments once the payments are processed by the bank. The reports also show the bills that were exempted from taxes for each outlet.

Reporting is an integral part of your business and it’s definitely the cane that guides you through your operations leading into better decision making and greater profits.